- Investors in developed countries tend to have a home bias, allocating more money to their domestic market than its global representation.

- A home bias can lead to increased return volatility and missed opportunities in better-performing regions, making global diversification important for long-term investors.

- A global market cap-weighted approach is recommended to efficiently capture market returns and minimise portfolio volatility across regions.

For one reason or another, equity investors across most developed economies tend to allocate more to their domestic markets relative to that market’s weighting in global benchmarks1. In Europe, our research found investors’ allocation to domestic stocks ranged from seven- to 30-times larger than the relevant country’s weight in the MSCI All Country Investable World Market Index2.

This bias towards home markets—often called a ‘home bias’—might be the result of a number of reasons, such as inertia, a fear of the unknown or a legacy from when global financial markets were less accessible to retail investors. For some clients, a home bias is a conscious decision. For example, research has found that investors tend to be more optimistic about the prospects of their domestic economies than foreign investors are, which can influence allocation decisions3. In some cases, investors might favour domestic markets to reduce exposure to foreign currency exchange risks.

Home market volatility

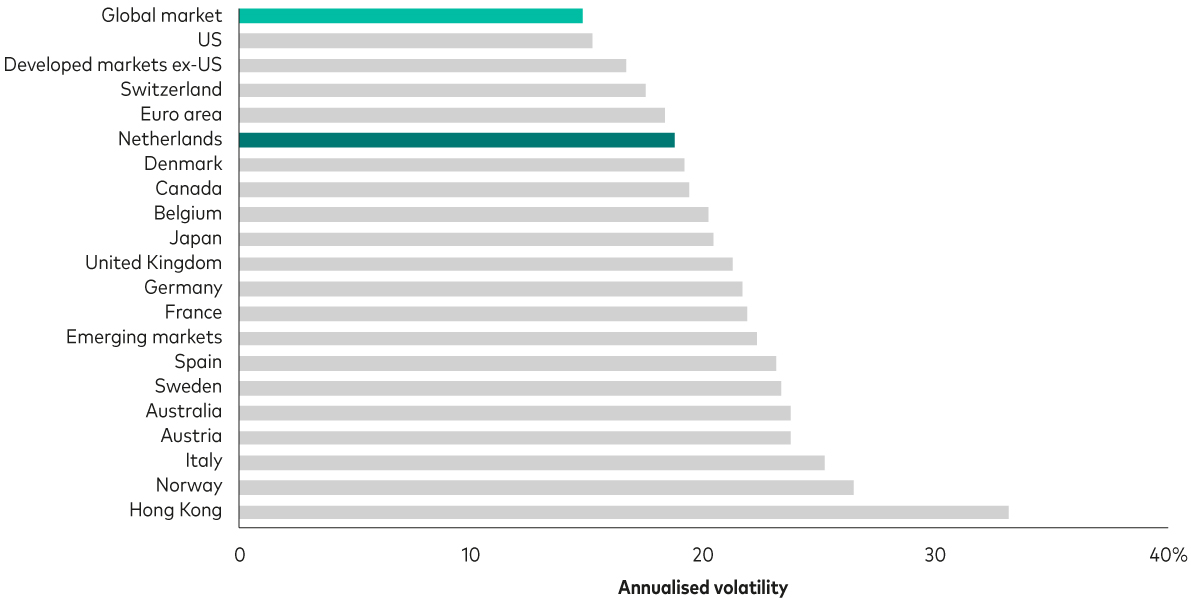

Whether intentional or not, it’s important that investors are fully aware of the possible implications of maintaining a home bias in their portfolio. Tilting investments towards a single market can increase return volatility, which is best demonstrated in the chart below that shows the volatility of global stocks compared with individual country indices over a 50-year period.

Volatility of returns by market

Past performance is not a reliable indicator of future results.

Sources: Vanguard calculations, based on data from FactSet, Morningstar and MSCI Notes: Data are as at 30 September 2020, for the period from 1 January 1970 to 30 September 2020. Country returns are represented by MSCI country indexes; the global market return includes both developed and emerging markets. Emerging markets are represented by the MSCI Emerging Markets Index, which began on 1 January 1988. The euro area is represented by the MSCI Europe ex-UK ex-Switzerland Index from 1 January 1970 to 31 December 1987, and the MSCI EMU Index thereafter.

As can be seen, domestic and regional markets come with greater return volatility than the global equities market as a whole. That’s why broad diversification across global markets makes sense for many long-term equity investors who want to minimise the volatility of their annual returns.

Another risk with overweighting client portfolios to domestic markets—or any other market—is that other regions might perform better over any given period. Adjusting a portfolio’s exposures to global markets based on which regions, sectors or individual securities are expected to outperform is notoriously difficult over the long-term. Global diversification enables investment portfolios to capture returns from whichever regional market is outperforming at any given time.

Sizing your allocation

The decision to invest globally is only the first step. The next step is to determine an appropriate allocation across regional markets. The standard asset-allocation approach, at both the global and local market levels, is to invest proportionally according to market capitalisation (market cap). In practice, that means spreading investments across all investable securities according to their relative representation in the universe, with more allocated to larger markets and to the larger companies within those markets relative to smaller markets and firms.

At Vanguard, we believe a global market cap-weighted approach is the most efficient way to achieve market returns via diversified exposures at low cost. As the global economy evolves, some markets will grow relative to others and a global market cap-weighted approach will reflect such changes within an investor’s portfolio.

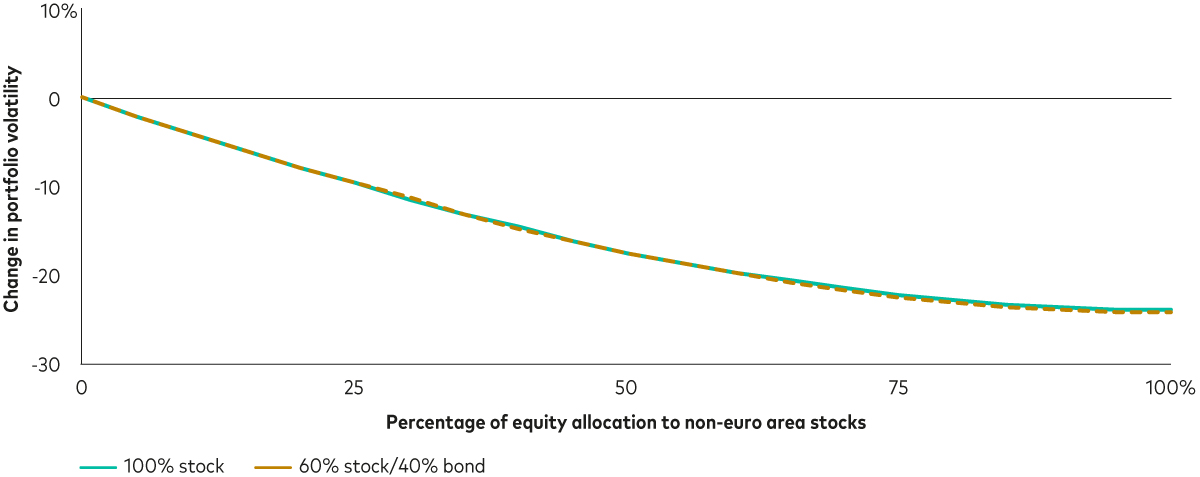

Because some markets are more correlated than others, the ideal allocation to international equities (based on minimising portfolio volatility) depends on the investor’s home market and its relationship with global markets. Previous Vanguard research analysed portfolio volatility after incrementally adding global equities to a 100% domestic equity portfolio for various regions, based on 10-year asset class return forecasts (calibrated in 2020).

For euro area investors, expected portfolio volatility declined the higher the allocation to global markets for both a 100% stock and a 60/40 portfolio of stocks and bonds, as shown in the next graphic.

Allocation to international equities is expected to reduce portfolio volatility

Source: Vanguard.

Notes: Ten-year expected returns are based on the median of 10,000 VCMM simulations, as at 30 September 2020, in EUR. Euro-area bond allocation is defined as the global market capitalisation of euro-denominated bonds. Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

This analysis was based on market return projections made in 2020 and our latest asset return forecasts may produce slightly different results if run again, but we believe the broad message stands – that euro area investors can reduce portfolio volatility the more they allocate to global markets.

Access global markets through LifeStrategy

While our research here is focused on global equity market returns, the principles outlined apply equally to bond market exposures. Based on our research and extensive experience in providing multi-asset solutions for long-term investors, we believe a global market cap-weighted approach to markets is a good starting point for all investors.

That’s why Vanguard’s range of LifeStrategy ETFs offers access to world markets through four global market cap-weighted portfolios with different equity/bond ratios that cater to the spectrum of client preferences and objectives.

A moderate tilt to home markets may be appropriate for some investors, which is where advisers can add value by weighing up a client’s individual needs and objectives with the risks of a home bias before guiding on a suitable portfolio allocation.

1 S.J. Donaldson; H. Ahluwalia; G. Renzi-Ricci; V. Zhu; A. Aleksandrovich, 2021. ‘Global equity investing: The benefits of sizing your allocation’.

2 Sources: Vanguard calculations, based on data from the IMF’s Coordinated Portfolio Investment Survey (2019), FactSet and MSCI. Notes: Data correct as of 31 December 2019, calculated in USD. Domestic investment was calculated by subtracting total foreign investment (as reported by the IMF) in a given country from its market capitalisation in the MSCI All Country World Investable Market Index. Given that the IMF data are voluntary, there may be some discrepancies between the market values in the survey and the MSCI All Country World Index Investable Market Index.

3 N. Strong; X. Xu, 2003. ‘Understanding the equity home bias: Evidence from survey data.’

IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time. The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include US and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, US money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Some funds invest in emerging markets which can be more volatile than more established markets. As a result the value of your investment may rise or fall.Investments in smaller companies may be more volatile than investments in well-established blue chip companies.

ETF shares can be bought or sold only through a broker. Investing in ETFs entails stockbroker commission and a bid- offer spread which should be considered fully before investing.

Funds investing in fixed interest securities carry the risk of default on repayment and erosion of the capital value of your investment and the level of income may fluctuate. Movements in interest rates are likely to affect the capital value of fixed interest securities. Corporate bonds may provide higher yields but as such may carry greater credit risk increasing the risk of default on repayment and erosion of the capital value of your investment. The level of income may fluctuate and movements in interest rates are likely to affect the capital value of bonds.

The Funds may use derivatives in order to reduce risk or cost and/or generate extra income or growth. The use of derivatives could increase or reduce exposure to underlying assets and result in greater fluctuations of the Fund's net asset value. A derivative is a financial contract whose value is based on the value of a financial asset (such as a share, bond, or currency) or a market index.

Some funds invest in securities which are denominated in different currencies. Movements in currency exchange rates can affect the return of investments.

For further information on risks please see the “Risk Factors” section of the prospectus on our website.

Important information

This is a marketing communication.

This article is directed at professional investors and should not be distributed to or relied upon by, retail investors.

For further information on the fund's investment policies and risks, please refer to the prospectus of the UCITS and to the KID before making any final investment decisions. The KID for this fund is available in local languages, alongside the prospectus.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information is general in nature and does not constitute legal, tax, or investment advice. Potential investors are urged to consult their professional advisers on the implications of making an investment in, holding or disposing of shares and /or units of, and the receipt of distribution from any investment.

Vanguard Funds plc has been authorised by the Central Bank of Ireland as a UCITS and has been registered for public distribution in certain EEA countries and the UK. Prospective investors are referred to the Funds' prospectus for further information. Prospective investors are also urged to consult their own professional advisers on the implications of making an investment in, and holding or disposing shares of the Funds and the receipt of distributions with respect to such shares under the law of the countries in which they are liable to taxation.

The Manager of Vanguard Funds plc is Vanguard Group (Ireland) Limited. Vanguard Asset Management, Limited is a distributor for Vanguard Funds plc.

The Manager of the Ireland domiciled funds may determine to terminate any arrangements made for marketing the shares in one or more jurisdictions in accordance with the UCITS Directive, as may be amended from time-to-time.

The Indicative Net Asset Value (“iNAV”) for Vanguard’s ETFs is published on Bloomberg or Reuters. Refer to the Portfolio Holdings Policy.

For investors in Ireland domiciled funds, please refer to our summary of investor rights this is available in English, German, French, Spanish, Dutch and Italian.

For Dutch investors only: The fund(s) referred to herein are listed in the AFM register as defined in section 1:107 Dutch Financial Supervision Act (Wet op het financieel toezicht).For details of the Risk indicator for each fund listed, please see the fact sheet(s).

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

© 2024 Vanguard Group (Ireland) Limited. All rights reserved.